July 10, 2024 |Business Strategy

by Liliana Robles, Sebastián Morales

The positive interactions of Lifestyle content neutralize the negative effect generated by the experiences associated with Product and Service in Banking.

Organic activity on social networks plays a very important role within the communication strategy of companies, as it allows them to develop a community of users who identify with the brands.

The unstoppable advance of technology, and the enormous amount of data being generated in digitization processes, is transforming the way businesses conduct their operations, driving efficiency, productivity and decision-making within organizations.

In this context, data management significantly affects customer management in a number of ways, influencing the way companies interact with consumers, and deepening the ability to deliver personalized products and services, according to their demands and interests.

In turn, personalization has a profound impact on improving the customer experience, which is one of the main drivers of companies’ success in terms of business growth.

Thus, personalized communication enables targeted marketing campaigns, ensuring that customers receive relevant messages based on their preferences and behavior. Thus, organic media activity, which focuses on the proposition of the value of companies to their community contributes to medium and long-term benefits, establishing authentic and lasting connections with their customers.

So, by taking, as a reference, a company in the banking industry, a category whose Net Promoter Score (NPS) is [-8.9%] below the market average, the impact generated by the organic activity of content on social networks is analyzed according to the three strategic pillars of brand content: Product, Service and Lifestyle.

Companies should consider that the development and growth of a community in social networks is based on establishing a good customer experience with the brand and an emotional bond with the users.

On the one hand, this company’s main objective is to minimize the negative comments that users make about the brand; and, on the other hand, to increase the net balance of users on social media, mainly on Facebook and Instagram, the latter an aspirational social network, in which brands are a natural reference of the community’s lifestyle.

Thus, with a 50% distribution of organic content activation on both platforms, 46% of organic activity is distributed under the Lifestyle pillar, 36% under Service, and the remaining 17% under Product.

Between [80%-90%] of the negative comments are concentrated on Product & Service, while the Lifestyle pillar drives up to 93.6% of the positive comments on Instagram, neutralizing the negative impact of the bank’s Product & Service offering.

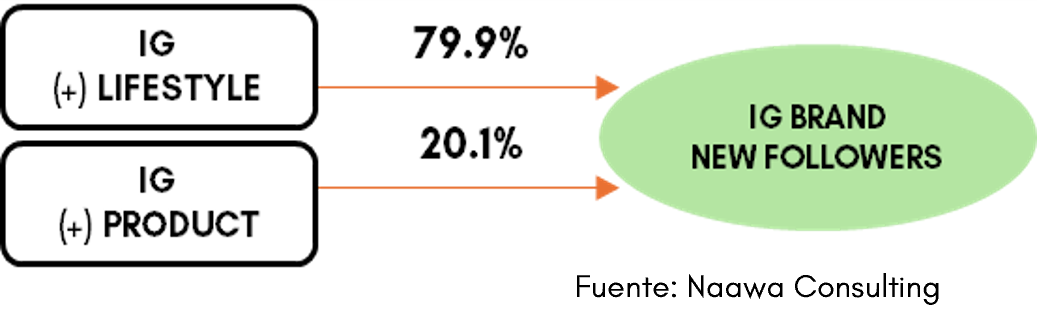

Applying machine learning techniques, it is observed that 8 out of every 10 new incremental followers generated by the bank on Instagram come from the bank’s, on new users limits the final net balance. organic content within the Lifestyle pillar, only 2 for Product. This makes the growth of the brand within the community on this platform unviable in the medium term, as the low positive contribution of Product and Service, vital in the bank.

Also, the Lifestyle pillar on Instagram breeds 1 out of every 2 positive mentions of the brand, while Product generates the rest, with Facebook contributing 2 out of every 3 positive mentions, and Instagram just one.

In addition, it is worth noting that, among other studies, the London School of Economics (LSE) estimated that an average increase in NPS by 7 points correlates with a 1% increase in revenue, highlighting the importance of delivering good service and tailoring products to the real needs of customers.

In other words, the negative experience with the bank reported by users on social networks, in terms of Product and Service, limits the organic growth of the community in a sustained way, something that is also reflected in the lower NPS levels of the Banking category.

This implies a strategic need for the bank to boost the improvement of customer relations, which is fundamental to consolidate the bank’s growth.

Therefore, the implementation of machine learning techniques allows, on the one hand, to identify the contribution of companies’ organic activity on social networks and, on the other hand, to establish realistic benchmark indicators that maximize profitability and strengthen organizations’ revenue growth strategies.

Liliana Robles is Business Solutions Partner at Naawa, Sebastián Morales is Business Solutions Partner at Naawa.

Copyright © 2024 Naawa Consulting. All rights reserved.