May 30,2024 |Business Strategy

by Sebastián Morales, José A. Miranda

The ability to match supply and demand in real estate is a key factor in maximizing selling prices.

The estimation of property prices based on advanced Machine Learning techniques allows to significantly improve the marketing strategies of companies in the real estate industry.

Real estate markets are influenced by complex economic, social and political factors, and must adapt to changing market conditions by considering uncertainty as a major component of risk assessment.

The importance of establishing the necessary strategies to monitor and respond to potential threats is critical to anticipate the future, so having information that facilitates tangible business decisions is strategic for organizations.

Real estate datasets are often heterogeneous, incomplete and dispersed, so ensuring data quality and consistency is crucial to the effectiveness of machine learning models. Therefore, it is necessary to create a data management strategy that allows to define and align the vision, goals, and actions of the company.

Thus, determining the market value of properties offered for sale or rent through factors such as amenities, location, size, orientation, services or the presence of green spaces play a crucial role in setting the right price for a home.

Currently, technological development and the capacity for continuous data collection make it possible to implement data-driven technological solutions based on advanced Machine Learning techniques, which facilitate estimating the target price for sale or rent based on incremental factors that affect the price of a property. According to the data analyzed and taking into account the great importance of the local level of marketing in this industry, it can be indicated that more than 50% of the current price of a property comes from the cost of land and taxes, especially at a time of high demand.

Companies must learn to adapt their growth strategies by identifying needs according to the profile of potential buyers in order to personalize and discriminate the commercial offer, thus shortening the purchasing process.

Undoubtedly, the financial impact of the time inventory remains on the market is one of the main factors that can influence the selling price, especially in a scenario of higher and longer interest rates such as the current one.

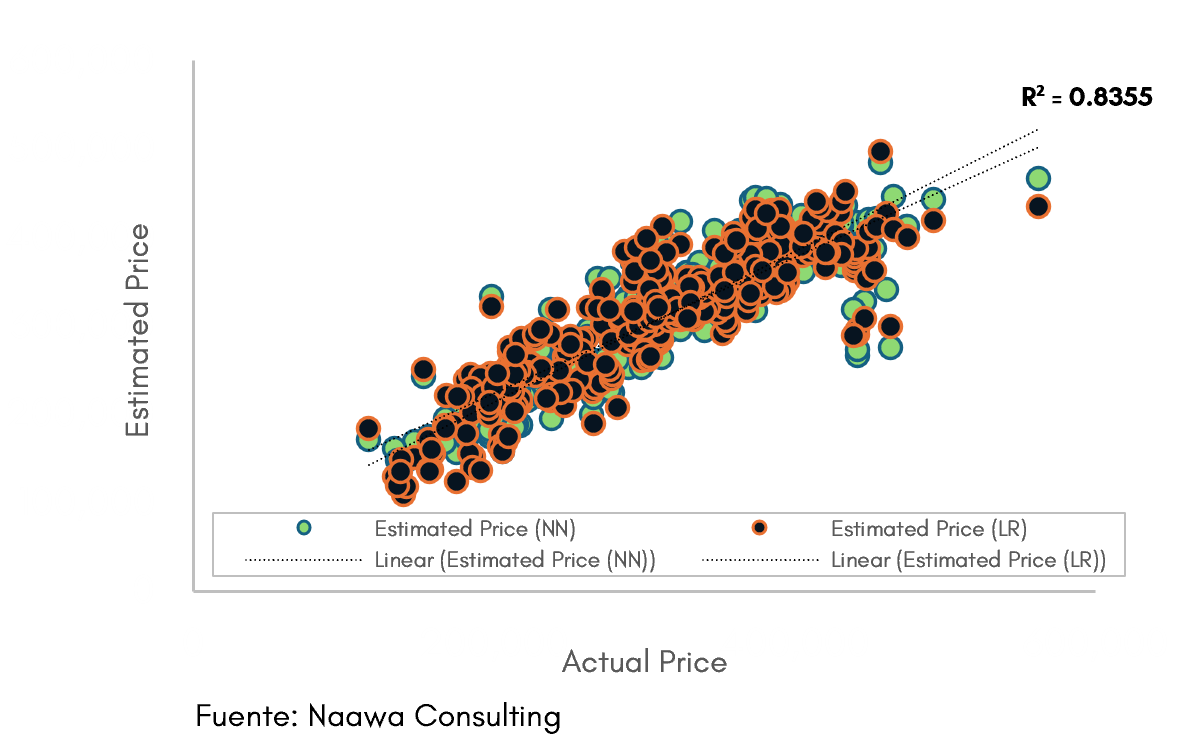

The implementation of machine learning algorithms makes it possible to identify behavioral patterns that facilitate more accurate and faster pricing, which increases the speed of response by companies throughout the sales process.

In this case, the sales price adjustment reached [+8.63%] using Neural Networks, since the learning of the algorithms is continuous in short time.

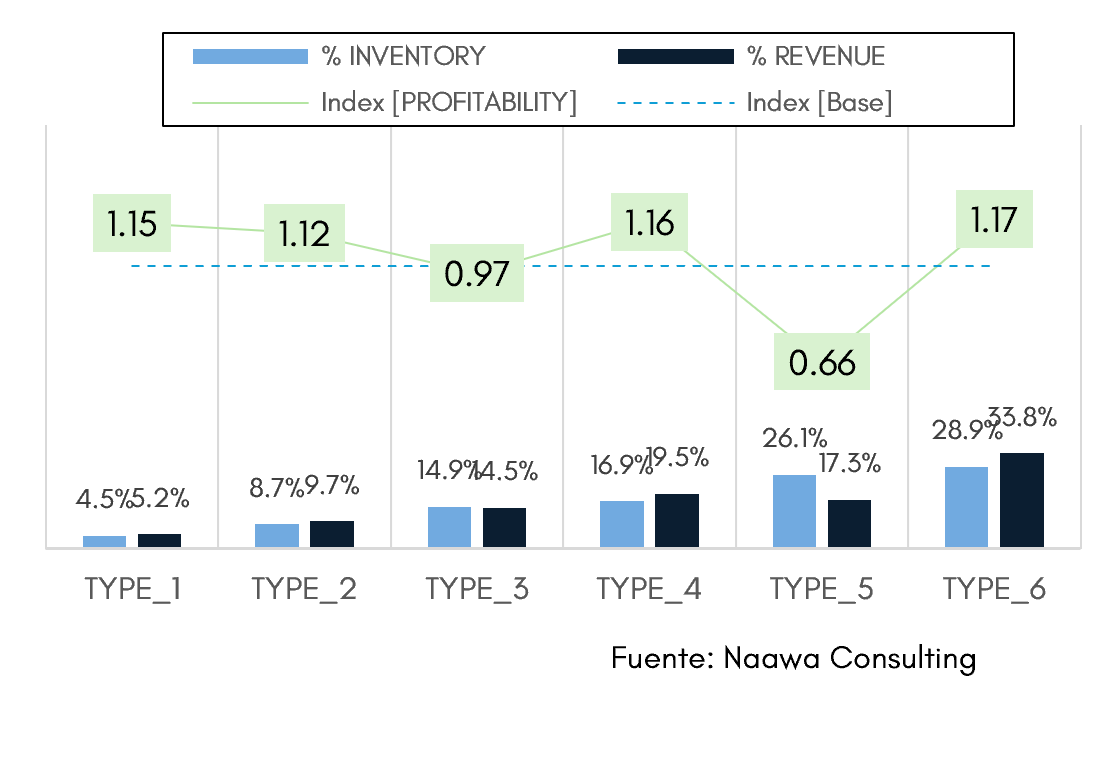

In addition, another fundamental factor to be considered in the price estimation, such as the adaptation of the offer according to the characteristics of the properties, it will enable to establish commercial strategies with a higher level of personalization, which has an impact on a better response on the part of the demand.

Indeed, by applying machine learning techniques to classify offer and demand, it is possible to improve profitability rates by up to [+17.0%], depending on the type of inventory; likewise, by identifying the least profitable property segments, companies can strategically prioritize resources on selling products with the highest yield potential.

Therefore, the implementation of machine learning techniques in the real estate industry allows companies to adapt to more agile purchasing processes, something that occurs in all industries. To do this, continuous quality data collection flows must be established to feed the databases, in real time, of both supply and demand, and to improve the quality and accuracy of the price estimation algorithms.

In addition, the identification of potential buyer segments based on real estate interests, will allow the development of contact strategies that to optimize revenue and efficiency based on supply and demand. This will allow companies to focus on marketing properties that maximize profitability and strengthen revenue growth strategies.

Moments of high market demand often putting upward pressure on prices, which can make it difficult to identify the heating risks facing the industry. Undoubtedly, the implementation of technology and good data management may open up new growth opportunities for companies in the real estate industry.

José A. Miranda is Managing Partner at Naawa, Sebastián Morales is Business Solutions Partner at Naawa.

Copyright © 2024 Naawa Consulting. All rights reserved.